A smarter approach to evaluating entrepreneurs and new products or services.

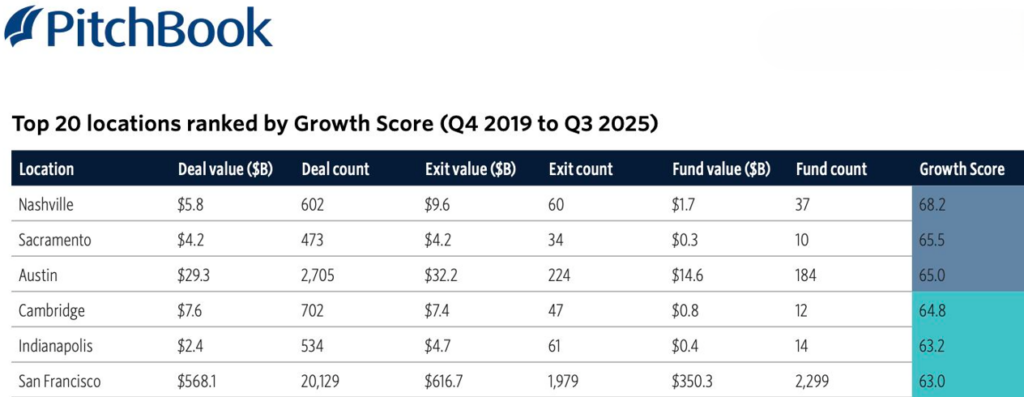

The InvestAbility Assessment Program (IAP) is a proven start-up analytical framework, developed in conjunction with the Nashville Entrepreneur Center (NEC), one of the most innovative and forward-thinking entrepreneur centers in the US. In December of 2025, Pitchbook released new rankings, and Nashville came in #1 nationwide for startup ecosystem growth from 2019-2025.

The resulting “Are You Investable?” (AYI) 3-week program is already now battle-tested by scores of entrepreneurs and business founders and is currently moving steadily into more founder / funder US markets and ecosystems. The programmatic approach and the many founder educational models built into AYI are singularly unique, vastly improving risk management for founders and their potential investors or backers of all types, systematically evaluating both:

Are You Investable? assesses these two core tracks separately, then merges the results in order to highlight each venture’s true strengths and gaps. Using AI, the program sharpens the founder’s pitch for investors, and also quantifies the traits which most often define winning ventures. Our system clearly saves significant time, money and frustration — while dramatically reducing due diligence time between founders, advisors, and investors alike.

In today’s fast-paced investment landscape, the gaps in intelligence, market or industry changes, and even boilerplate due diligence handling, may at times stop investment in an otherwise promising new venture.

Now there’s a chance to dig deeper, in advance, to better quantify the new business product or service potential, and more accurately identify the true risks. We bridge these common gaps, and better prepares founders by:

Assess the founder and the proposed team’s credibility and long-term potential, review prior experiences and career backgrounds of the team, and investigate their collective ability to actually execute the plan and to create a viable, profitable enterprise.

Examine the founders’ proposed financial structure, early and extended projections, and specific reasons for the presented forecasts. Bring in fractional CFO analysis where warranted and review the spending plan and timetable for maximum capital efficiency.

Evaluate how well your product or solution aligns with marketplace demands for change or improvement, define and quantify the specific, realistic addressable market and recognizing industry trends or changes which may affect market success.

Assess the Go-To-Market plan — specifically in communication, marketing and sales – identifying “exactly where the customers are” for the product or service (B2C, B2B, B2B2C, or other channels), the true cost of customer acquisition and sales channels processes.

Review the entire product or service operations planning, procurement and supply chain issues or concerns, and test the assumptions of the proposed revenue model, including pricing strategies, marketing and sales activities, plus overall sustainability and growth.

Identify the company’s ability to grow the revenue and operations, expand into secondary or parallel markets, scale the product or service efficiently, and grow continuously within a relatively fixed cost environment allowing aggressive expansion and sustainable scaling.

Book YOUR FREE 30-Minute Consultation now! see How "Are You Investable?" could help Scale your Current Business or New venture!

The Bull Pen is where founders put their ideas to the test. It’s a live, digital pitch arena where your IAP results meet real investor-style evaluation. Sharpen your story, prove your numbers, and get actionable insights before stepping into the real market.

Discover your InvestAbility Score and gain the clarity you need to move forward with confidence.

Get a clear, objective readiness score Identify strengths and fixable gaps Gain confidence before pitching Access proven tools & roadmaps

Quickly assess startup investability See standardized red/yellow/green signals Compare founders with consistent benchmarks Save time filtering deal flow

FAQs

Most founders complete the assessment and feedback cycle within 2–3 weeks, depending on scheduling.

Just your pitch deck, basic financials, and answers to a short intake questionnaire. We’ll guide you through the rest.

Your business is evaluated by experienced investors, operators, and subject-matter experts with real funding experience.

The IAP fee ($3,750) is paid upfront via secure online checkout. Invoices and receipts are provided for your records.

The industry’s first AI-powered system connecting entrepreneurs with the investors most likely to fund their ventures.

Using dozens of data points — from industry and sub-sector focus to funding range, company stage, and portfolio makeup — our AI identifies investors with a natural fit for your startup.

This process opens your venture to thousands of qualified investors across North America, far beyond your local network. You’ll receive a curated list of ideal matches to review and choose which investors to contact. You can reach out directly, or our team can facilitate introductions and calls.

Our system eliminates wasted time on mismatched leads, removing over 90% of investors outside your target scope.

Note: Investors never pay any fees. Your company stays in our matching network until you reach your goals or request removal.